What is Impact Investing?

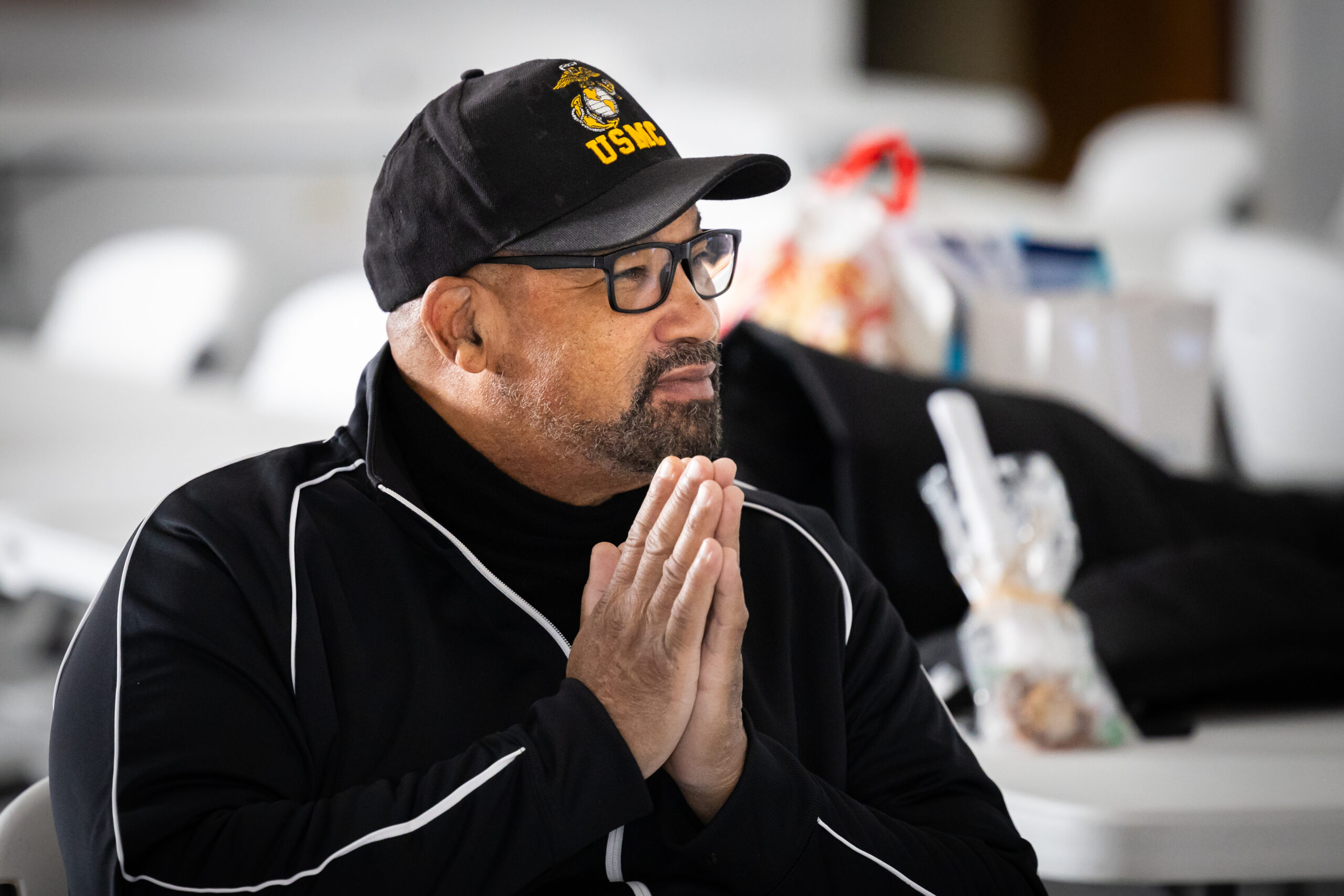

Cone Health Foundation (CHF) defines impact investing as investment activity that intends to generate positive social and financial returns. The practice focuses on activating new financial resources to address social and environmental issues.

Our Journey Towards Impact Investing

The Foundation’s journey towards impact investing started with investments in local CDFIs (Community Development Financial Institutions) in 2018. We evaluated the strong impact in Greensboro and beyond that these organizations, such as the Latino Community Credit Union and Self-Help Credit Union, could deliver. However, most of our portfolio remained invested in traditional financial instruments.

We saw the confluence of impact and return and knew our portfolio could be more transformative and intentional around our mission. In 2020, we launched a process to fully leverage our portfolio, starting with a competitive search process for a new investment consultant. We then embarked on determining core values around which to restructure our portfolio.

After this transition, we became 100% integrated across environmental, social and governance (ESG) factors and impact investment focused. We developed a fully diversified asset allocation with investments across public equities, fixed income, and alternative investments with a focus on alignment of the organization’s values and long-term financial performance. We hired a strong combination of managers to execute our vision. We also emphasize the hiring of BIPOC and women-led or owned firms, with strong attention on diversity of investment professionals and next gen leaders.

Our Investment Policy and How it Works

CHF’s investment policy establishes a goal of spending 5 percent of a 12-quarter rolling average of the market value of our assets. Our investment policy also has explicit language aligning our values within our investment objectives. We developed an ESG Policy Statement that codifies our values and alignment with our investments. We use the policy statement to screen various investments and promote other high impact areas.

We promote health and welfare themes and restrict alcohol, tobacco, unhealthy foods/beverages, firearms and gambling investments. We also have a number of impact related investment themes running through the portfolio including:

- Divestment from fossil fuel companies

- Clean energy and new resource economy

- Gender and racial equity, with a DEI focus on removing barriers that perpetuate the wealth gap

- Strong corporate governance

- Community investments with a target on disadvantaged geographies and focus on low income housing, non-profits, education, healthy foods and other community projects